Will Desert Mountain Energy rise to the top?

It’s been a challenging few years for Desert Mountain Energy (TSX-v: DME) / (OTCQB: DMEHF) and most helium (“He”) hopefuls, but there’s light at the end of the tunnel. Readers are reminded that Desert Mountain is highly speculative due to its small size and the complex technical, regulatory & legal nature of proposed operations.

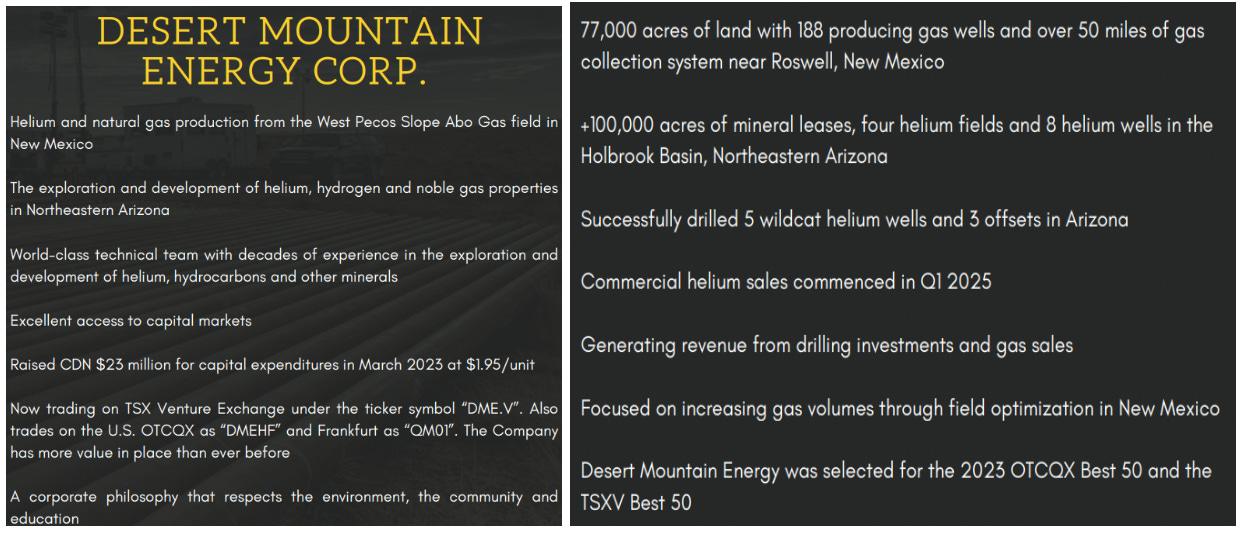

The Company currently has modest He & natural gas production from its West Pecos Slope Abo gas field in the southwestern state of New Mexico (“NM”). Before NM, the Company successfully explored for He, hydrogen, and noble gas on properties in northeastern Arizona (“AZ”).

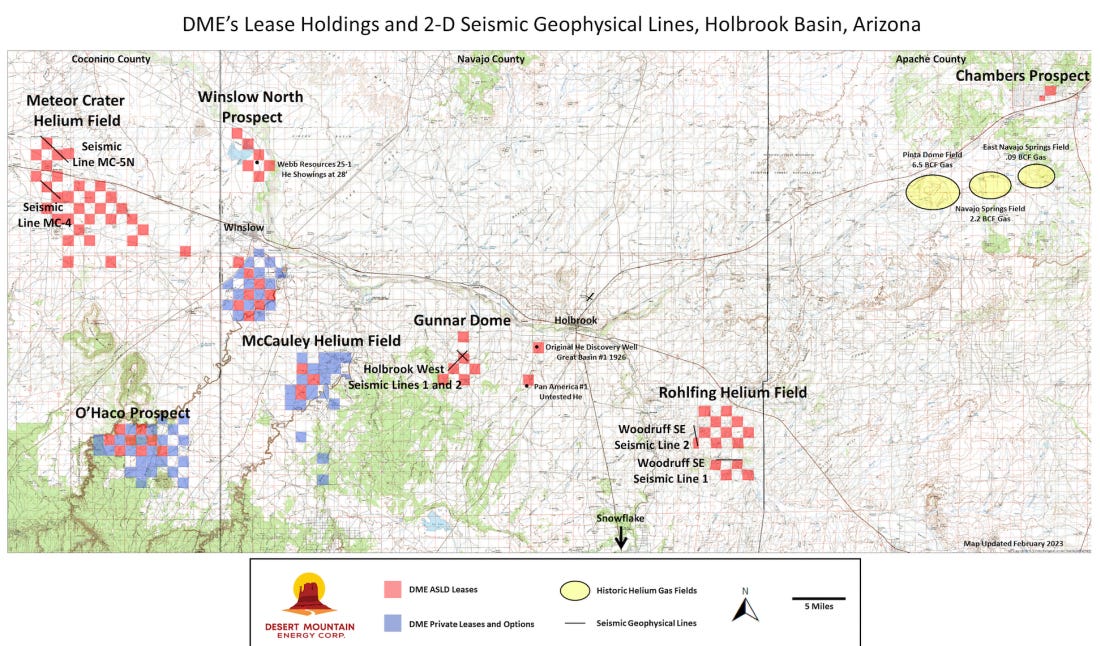

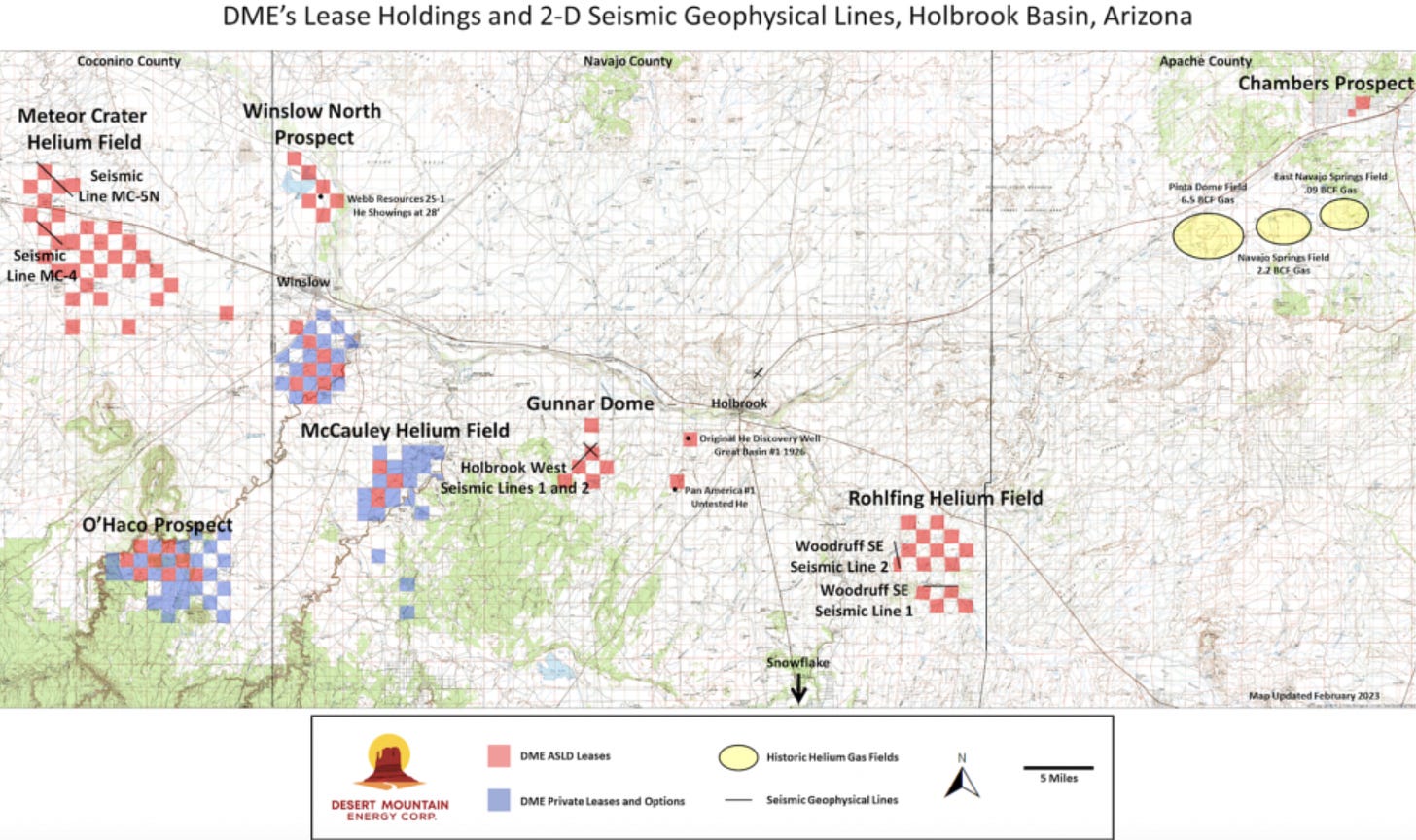

In AZ it holds mineral leases on state & private lands, totaling > 100,000 acres, and successfully drilled five wildcat wells + three offsets —> identifying multiple He fields. Readers are reminded that Desert’s market cap reached ~C$330M in 1H/2022 on the AZ assets alone.

Granted, He prices were stronger, but even if potential operations are worth a quarter or a third of what they were, that’s $82.5 to $110M, compared to the current valuation of ~$21M for BOTH AZ & NM.

Note: management is in the middle of raising C$2M. Despite the palpable angst of a few posters on CEO.ca, on September 30th Desert had $1.7M in current assets vs. $0.4M in current liabilities, zero long-term debt, and fewer than 100M shares. Total assets were $50.5M.

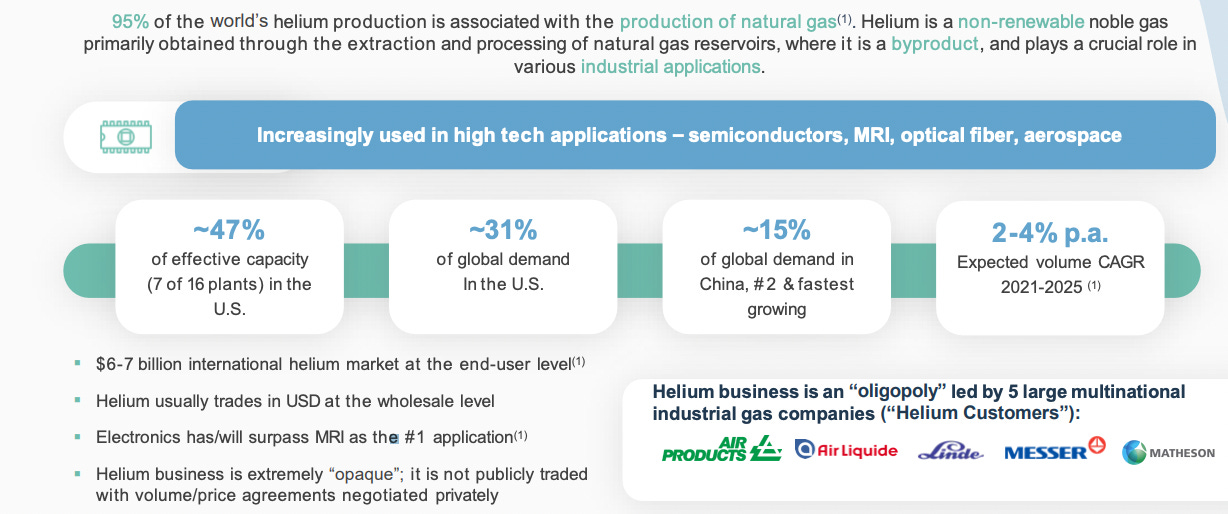

The region of AZ that Desert drilled returned He grades of 3.5 to over 7.0% in a district known for grades of 8-10%. Compare that to commercial production (as a byproduct of nat gas) of ~0.2 to 1.0%, averaging ~0.5-0.6%.

The Company expects to commence He production in Arizona if/when permits for stimulation work are obtained. A very considerable amount of effort has been made with lawmakers, and management hopes to update the market this month.

Additional tangible assets are held in NM, including 77,000 acres containing 188 gas wells + oil/gas leases, and > 50 miles of a gas collection system near Roswell. Some are understandably concerned that CEO/Exec. Chair Robert Rohlfing & Pres./Dir. Don Mosher burned through equity capital with little to show for it.

I completely disagree! In AZ, the Company was dealt a serious (regulatory/legal) blow and made the best of it. Recognizing that it would take time to right the ship, they pivoted to NM while retaining the blue-sky opportunity in AZ. In mid-2023, management closed the purchase of the West Pecos gas fields & gathering system in Chaves County, NM.

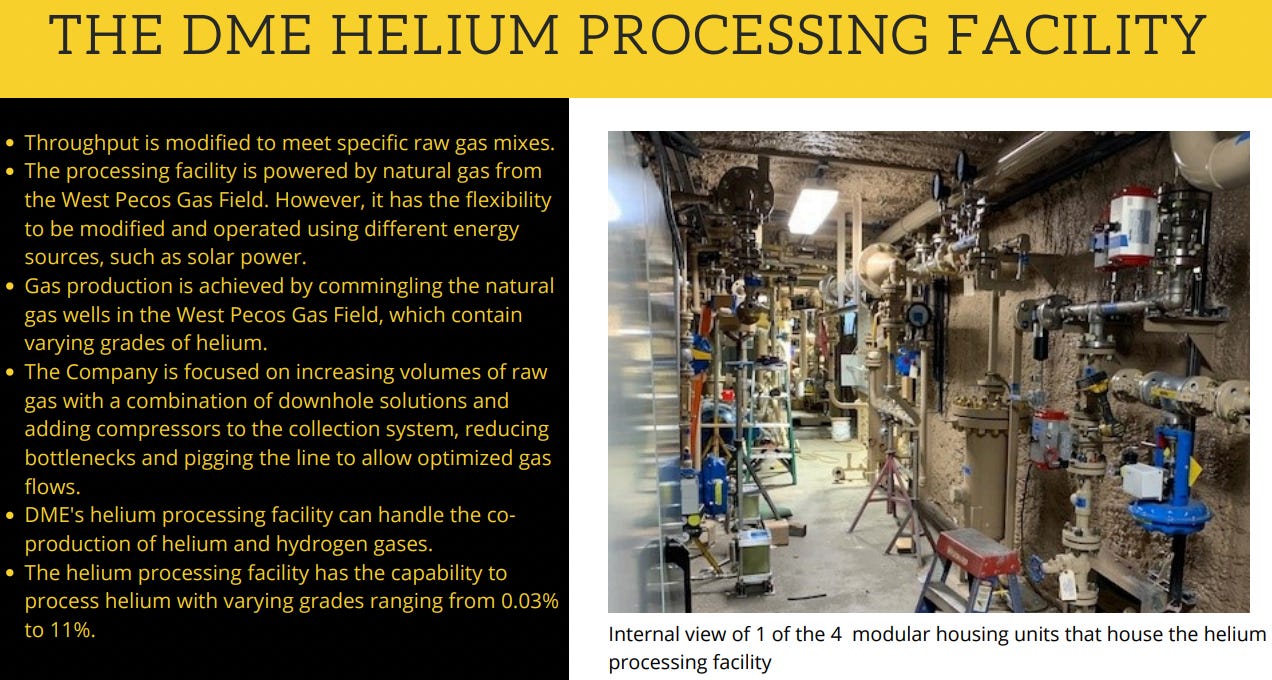

The Company is in the process of working over wells and utilizing its mobile modular & scalable He processing plant. Unfortunately, NM has not been smooth sailing either. Numerous equipment problems were encountered. According to a recent PR,

“DME’s technical team worked through numerous challenges since the plant’s start-up in June 2024. The team encountered malware & ransomware, wiring problems, and components not meeting engineering standards. The Company enlisted an automation team to rewrite software, enabling the company to avoid ransom demands from the malware creators. Upgrades were made to wiring, switchgear, and bottlenecks were addressed.”

Yet, cash spent on fixing problems, legal bills & maintenance on wells is not wasted capital, it’s a cost of doing business. While critical decisions remain about the future of Arizona & NM, the path forward seems less treacherous as management hopes to turn a modest profit in 2025.

In NM, the Company has an ongoing pilot test providing low-cost, reliable, natural gas to a third-party operator of cryptocurrency mining equipment. Since energy is one of the largest operating costs in that realm, every tenth of a penny saved per kWh is crucial.

That operation is modular, so if the crypto-miner successfully uses Desert’s natural gas to power its generators, it could rapidly scale the business model, provided that management is interested in delivering more gas.

Desert is not making much from the pilot test, but pilot tests are not about earning profit. They’re done as proof of concept and to gather critical data to better understand operating capabilities and assess ensuing opportunities.

Some readers might want to hear that management is pursuing cryptocurrency mining with low-cost energy to capture more of the economics. However, that’s only a possible path, and it would introduce a new set of risks & uncertainties. While not as sexy, sticking to the knitting of nat gas + He has its advantages.

Another prospect is providing gas to support data centers. When I first heard about the data center connection I rolled my eyes — the Company is too small to power a data center! However, Desert would be among several or dozens of players serving data center clients, and/or crypto-miners.

NM is attracting data centers due to a combination of geographic, economic, climate (low humidity, moderate temperatures) & regulatory advantages. The State enjoys a very low risk of natural disasters, low electricity costs and is strategically located in the SW near Maricopa County, AZ, [Dallas/Fort Worth, Texas] & Denver, Colorado.

As cash burn approaches zero, and turns positive, the alternatives in NM & AZ will only grow. Importantly, Desert has not one, but two important inputs for high-tech industries / R&D plants.

Low-cost, reliable natural gas, and He. Helium processing facilities at West Pecos were recently brought online — over several months — due to the equipment issues mentioned earlier.

The plant is now separating He from the natural gas stream. A maiden truckload is expected to ship this month. Based on current production volumes, management hopes to fill a truck with He every 18-21 days. This rate should improve as gas volumes & He percentages increase.

Over time two trucks a month, and then three trucks as a medium-term goal. The margin on He sales is expected to be robust. Three truckloads a month could generate several million dollars/year in profits from He alone, from just NM.

A clearer cash flow estimate depends on the mix of He grades the Company sells, the higher the grade, the higher the margin. The plant can produce up to 99.9995% purity.

Additional monthly cash flow is coming from natural gas sales, also with robust margin expectations. If Rohlfing & Mosher could sign long-term He contracts with companies like Raytheon Technologies (now called RTX Corp.), or esteemed research institutions like NM’s Los Alamos and/or Sandia National Laboratories — that would meaningfully de-risk the story.

Helium is needed to manufacture semiconductors & fiber optics, for rockets & space expl./development, quantum computing, and MRI machines. Importantly, commercial He sales started this quarter.

Desert is streamlining its collection system and considering additional wells, pipelines & equipment to make it more amenable to serving high-value clients. On top of reworking wells, an incremental 70-100 wells could be developed in the coming years.

After processing raw gas through the 100%-owned He processing facility, revenue is generated from both He & natural gas sales. Over 60% of the Company's NM leases are on federal Bureau of Land Management (“BLM”) properties.

Rohlfing & Mosher believe the new administration in Washington, D.C. should bring additional favorable changes to its operations — Drill baby Drill!

In AZ, the Company continues to negotiate with regulators & lawmakers to establish definitive guidelines for He production. Management is collaborating with Beam Earth Ltd. and Hethos Ltd. to advance hydrogen plays alongside its He assets.

Discussions about the potential to replicate Desert's plant design in other regions are ongoing. One day there could be multiple gathering systems like the one in Roswell, NM, feeding data centers, and other end-users.

Desert Mountain could sell minority interests to largely fund new clusters of wells, pipelines, and equipment centered on the Company’s He facility design that they know inside and out.

I mentioned hard, tangible assets in NM, to reiterate, there are 100,000+ acres of mineral leases, four He fields & eight He wells in the Holbrook Basin in NE Arizona. Desert gets virtually no credit for its hard assets in AZ, but they could be a company-maker next year.

{Yes, I know, it’s always next year… Let’s see what management + Earth Ltd. + Hethos Ltd. can do.} Regarding legal action with the City of Flagstaff, on Jan. 8th, the trial court dismissed three more claims, reducing the total to six of the original 11 claims.

2025 could be transformational for Desert Mountain Energy (TSX-v: DME) / (OTCQB: DMEHF), but with great potential comes substantial ongoing risks. If cash burn can be eliminated (except for growth cap-ex, but that can be shared with or entirely borne by partners), the risk profile will improve, buying time for multiple corporate initiatives in NM & AZ to come to fruition.

Disclosures: Desert Mountain Energy is a highly speculative small-cap company that is burning cash. Although cash burn could cease within a year, delays and unexpected problems have occurred and could happen again. Readers are urged to consult with investment advisors before investing in highly speculative stocks.

At the time this article was published, Mr. Epstein of Epstein Research owned shares of Desert Mountain purchased in the open market. Desert is considering signing up for 3 months with Epstein Research at US$2,000/month. Mr. Epstein should be considered biased in favor of Desert Mountain Energy.